Capital investment is the process where money is put into a business aiming for future profit generation. This long-term investment can take many forms, including asset acquisition, technology upgrades, production expansion, or infrastructure development.

Understanding the significance of capital investment is crucial for any business’s growth and success. It enhances productivity, efficiency, and competitiveness. By expanding operations, introducing new offerings, and exploring new markets, businesses not only create job opportunities but also contribute to a country’s economic development.

Diving deeper, let’s explore the types and workings of capital investment:

- Financial Capital Investment

- Nature: Investment in financial assets like stocks, bonds, mutual funds.

- Types:

- Equity Investments: Acquiring company shares for ownership.

- Debt Investments: Purchasing bonds or lending money for a fixed interest.

- Functioning: Investors aim for returns through dividends, interest, or capital gains, achieving a diversified portfolio.

- Examples: Bonds, stocks, mutual funds, ETFs.

- Physical Capital Investment

- Nature: Investment in tangible assets like property, machinery.

- Types:

- Land and Building: Acquiring or constructing properties.

- Equipment and Machinery: Procuring essential tools and machines.

- Functioning: Requires significant upfront investment but offers long-term returns.

- Examples: Land, buildings, equipment, vehicles.

Considering a capital investment? Here are some critical factors:

- Return on Investment (ROI): The profit ratio to the investment cost.

- Risk: The possibility of loss, which can be mitigated through diversification and thorough research.

- Time Horizon: The duration of holding an investment, affecting potential returns.

When it comes to financing capital investment, businesses often leverage:

- Equity Financing: Selling company shares.

- Varieties: Common and preferred stocks, crowdfunding, angel investors, venture capitalists.

- Functioning: Investors get partial ownership and a share in profits.

- Pros and Cons: No repayment required, but potential loss of control and dilution of ownership.

- Debt Financing: Borrowing funds to be repaid with interest.

- Varieties: Bank loans, corporate bonds, trade credit.

- Functioning: Borrowing with an agreement to repay with interest.

- Pros and Cons: Maintains ownership but involves regular payments and default risks.

- Hybrid Financing: A blend of equity and debt.

- Varieties: Convertible debt, mezzanine financing.

- Functioning: Offers flexibility and combines features of both debt and equity.

- Pros and Cons: Balances risk and reward but can be complex.

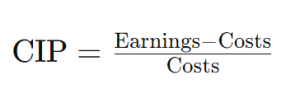

To evaluate the capital investment’s worthiness, the capital investment formula is used:

Here, CIP represents Capital Investment Profitability, with ‘Earnings’ being the net cash inflows and ‘Costs’ the initial investment.

The Bottom Line

Capital investment is a pivotal decision for businesses, influencing long-term success. It requires a balanced analysis of cash flows, risks, and returns to identify the most fruitful opportunities.